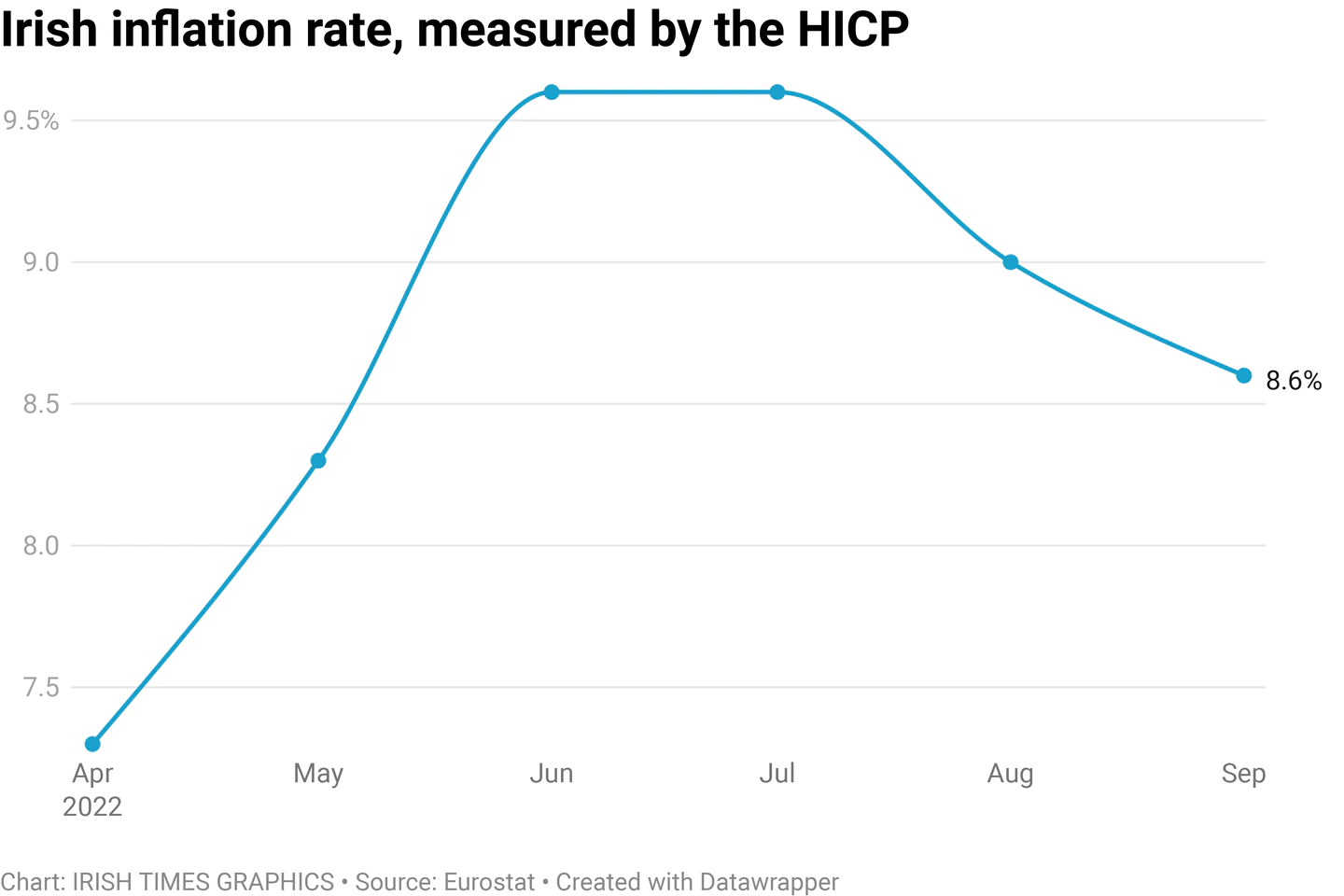

Irish inflation as measured by the European Union eased slightly in September, although prices rose at a record annual rate across Europe.

The harmonized consumer price index for Ireland rose 8.6% in September from a year earlier, Eurostat said in a statement. That compares with a 9% gain in the year through August.

Commenting on the data, Anthony Dawson, a statistician in the prices division of the Central Statistics Office, said only three of the 19 eurozone countries had an annual increase lower than the estimate of 8.6% for Ireland, while 15 countries had higher rates. Estonia had the highest estimated annual inflation at 24.2% while France had the lowest at 6.2%.

Mr Dawson said the estimates, which are subject to revision when finalized next month, suggest Irish energy prices were flat through September but rose 38% over the month. year.

“For the Eurozone as a whole, energy prices rose 3.0% in the month and 40.8% on an annual basis,” he said.

As inflation in Ireland has slowed, the eurozone economic crisis has intensified with the first-ever reading of double-digit inflation, putting pressure on the European Central Bank to keep rising interest rates aggressively.

Consumer prices jumped 10% from a year ago in September, Eurostat data showed on Friday. That’s more than the median forecast of 9.7% in a Bloomberg survey of economists, and marks the fifth month in a row that the result beat the consensus.

Energy and food again fueled inflation, although an underlying measure that excludes them also beat estimates to a record high of 4.8%.

This data has proven key in providing momentum for strong rate hikes in previous months, and this result is likely to encourage calls for another big move when the ECB next decides on October 27. Investors this week began pricing on a second consecutive 75-point increase.

“The next step must still be important because we are still far from rates compatible with 2% inflation,” Martins Kazaks, a member of the ECB’s Governing Council, said on Wednesday in an interview in Vilnius, Lithuania, where growth prices was 22.5%”. . “I would be on the side of 75 basis points.

As officials escalated their aggression with a move of this magnitude on September 8, they also sought to differentiate the eurozone experience from that of the United States, insisting that inflation in their own region is much more supply driven than demand driven. propelled the consumer price situation across the Atlantic.

Even so, policymakers will be nervous about another record. Boris Vujcic, the Croatian central bank governor who will join the Governing Council of the ECB in January, warned in an interview published this week that “when inflation is high, when it approaches double-digit levels, it can become a disease in itself.

As Russia starves Europe of gas and winter approaches, policymakers brace for even tougher months. Price increases could accelerate further in some countries, while recessions become more likely.

The latest OECD forecasts point in this direction. Officials on Monday raised their projection for euro zone inflation next year by 1.6 percentage points to 6.2%, significantly beating the ECB’s own outlook. Hours later, ECB President Christine Lagarde repeated that her officials also saw the danger of a higher result.

“Risks to the outlook for inflation are mostly on the upside, primarily reflecting the possibility of further major disruptions in energy supply,” she told lawmakers. “We expect to raise interest rates further in upcoming meetings to dampen demand and hedge against the risk of a persistent rise in inflation expectations.†

A relatively tight labor market can intensify these pressures. A separate Eurostat report showed that unemployment in the euro zone remained at a record high of 6.6% in August.

Ahead of the inflation data, each of the 40 economists polled by Bloomberg predicted a record result this month, with four counting on 10%.

The actual result masked considerable divergences in the Eurozone. In Germany, Europe’s largest economy, price growth jumped much more than expected.

The end of summer discounts on public transport and fuel helped push it up 10.9%, the highest overall rate seen in the industrialized economies of the Group of Seven since the start of the energy crisis. Italy, the Netherlands and Belgium also experienced significant accelerations.

In contrast, price growth unexpectedly slowed in France and weakened much more than expected in Spain. — Additional reports: Bloomberg

#Irish #inflation #slows #euro #zone #sees #record #price #rises