Bank of Ireland has been fined a record €100.5million for its role in the state mortgage scandal which led to huge overcharging of borrowers and a loss of 327 homes in the sector scale.

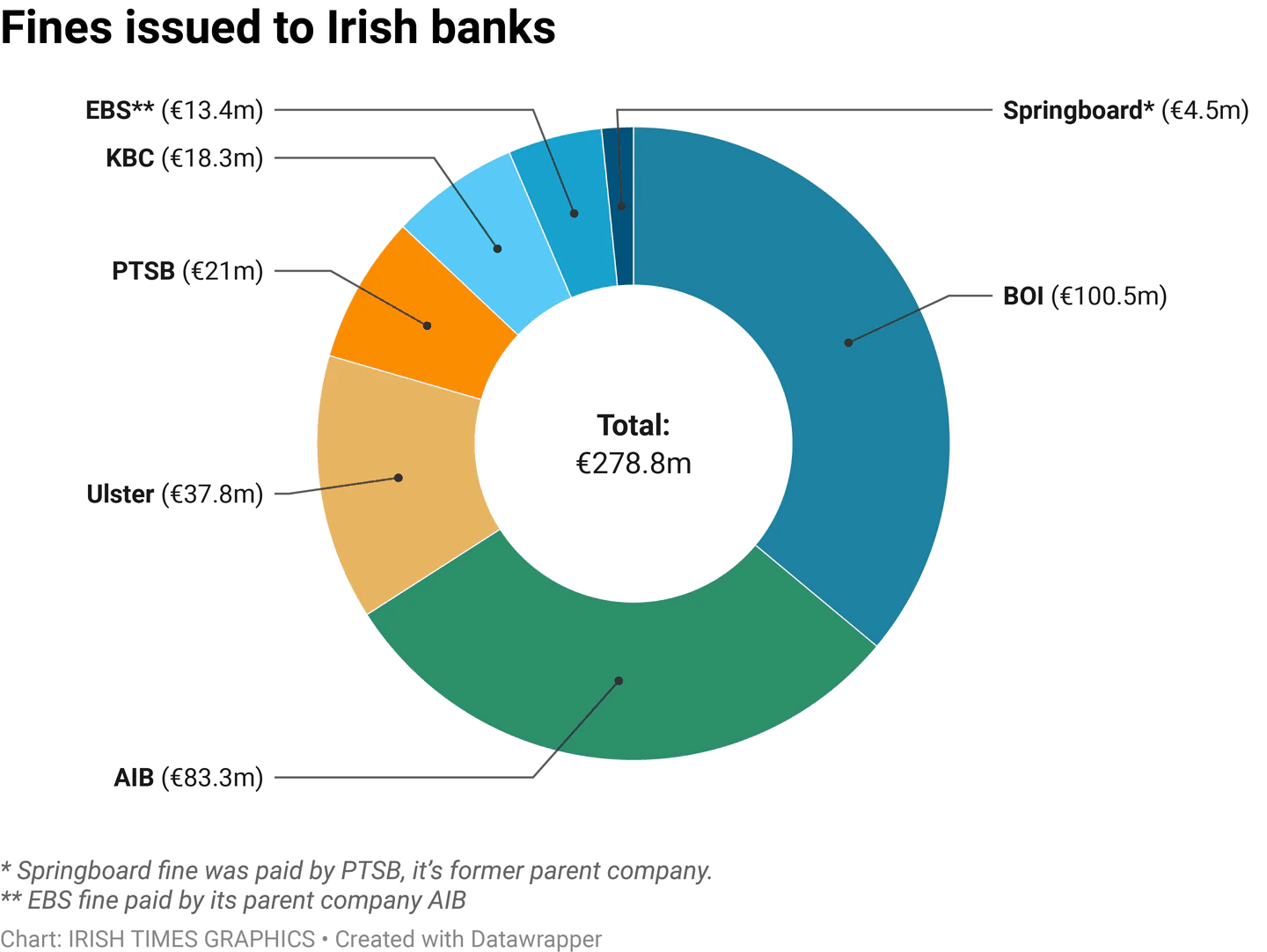

The Bank of Ireland sanction eclipsed the previous record of 96.7 million euros set against AIB and its subsidiary EBS in June – and brings total tracker fines against seven lenders under enforcement investigations for almost 279 million euros.

The Central Bank said the bankruptcies of Bank of Ireland resulted in the loss of 50 properties, including 25 family homes, which would have been avoided if it “had adhered to the most basic fundamentals of its consumer protection obligations “.

Industry-wide property losses amounted to 327, of which 98 were single-family homes, according to figures in individual penalty cases.

Bank of Ireland’s fine comes on top of the €186.4 million it has already paid to 15,910 affected customers, who were identified before and as part of the Bank’s mortgage review central.

The Bank of Ireland has admitted 81 separate regulatory breaches as part of the regulatory inquiry, covering a period between 2004 and June this year in which customers were denied their right to a cheaper mortgage following the interest rate of the European Central Bank (ECB) or have been put on the wrong rate.

The regulator found that the Bank of Ireland, which stopped offering tracker loans at the height of the financial crisis in October 2008, provided unclear documentation to customers before then assessing their rights to a tracker rate after a fixed rate period.

[ Analysis: Last tracker fine against an Irish bank does not bring saga to an end ]

The Bank of Ireland, on several occasions, over a period of more than nine years, interpreted these unclear documents in its own favor and refused customers a follow-up rate, she said. Even when she acknowledged the extent of the wrongdoing, her initial proposals for reimbursement and compensation failed to live up to the expectations of regulators and “revealed a lack of understanding or consideration on her part. as to the impact his failings had on his clients”.

As recently as June, some six new cases were identified for refunds and compensation, Central Bank officials told reporters on Thursday.

“Customers have the right to expect to be treated fairly and that financial institutions act in their best interest. Bank of Ireland has failed to meet these most basic expectations for nearly 16,000 of its customers over an extended period,” said Seána Cunningham, director of enforcement at the Central Bank.

“Our investigation revealed a culture within the Bank of Ireland which, when faced with a choice, put its own interests first with little or no regard for the impacts on its customers. There have been a series of missed opportunities where Bank of Ireland could have done the right thing by its tracker mortgage customers.Despite these opportunities, Bank of Ireland repeatedly interpreted unclear contract terms in its favor and against the customer, which which continued damage and loss to customers for many years.

Although the regulator determined an appropriate fine for the bank at 143.6 million euros, it reduced it by 30%, in line with the standard reduction applied to settled cases.

Permanent TSB (PTSB) and its former subprime unit Springboard Mortgages, KBC Bank Ireland and Ulster Bank have each been hit with sanctions in recent years.

More than 41,000 borrowers were affected by the debacle in the sector, which dates back to 2008. Irish banks have in recent years made 1.5 billion euros in provisions in connection with the scandal of trackers.

The tracker issue has so far cost the Bank of Ireland almost €330 million since 2016 in refunds and compensation, legal and administrative fees, and provisions made for a Central Bank fine.

The impending closure of the Bank of Ireland case comes days after the government announced last Friday that it had sold its remaining shares in the lender, making it the first to return fully to private ownership following the bailout of 64 billion euros by the state in times of crisis financial system.

Irish lenders stopped issuing trailing mortgages – where interest rates are typically set at a one percentage point premium to the European Central Bank’s main lending rate – in 2008, as their own funding costs soared amid the global financial crisis.

While holders of tracker mortgages benefited from the drop in the ECB’s benchmark rate from 3.75% at the end of 2008 to zero in 2016 – and borrowers on other products faced higher fees – tracker loans were automatically affected by the recent ECB rate hikes. The ECB has raised its main policy rate to 1.25% since late July and is on track to raise borrowing costs further in the coming months.

#Bank #Ireland #slapped #record #100m #fine #mortgage #tracker #scandal